Shanghai copper edged down yesterday, chasing falls in London from an intraday high in the previous session, as investors contend with worries about Chinese growth on the one hand and positive US data on the other.

Western investors fret that Chinese attempts to curb overcapacity in some sectors, including steel, cement and silicon will slow demand growth for base metals.

Copper for three-month delivery on the London Metal Exchange rose US$19 to US$6,310 a ton in early trade, having ended down 0.3 percent in the previous session, when prices touched a high of US$6,408.50.

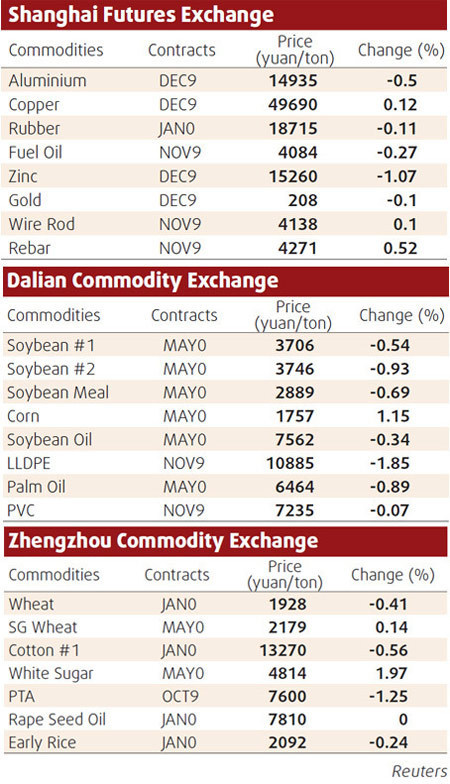

Shanghai's benchmark third-month copper eased 0.7 percent to 49,660 yuan.

The discount for Shanghai copper versus London narrowed slightly to 778 yuan from around 800 yuan on Wednesday and has fallen by more than half this week.

"It looks like we have seen liquidation in London but Shanghai doesn't want to follow," a dealer in Shanghai said.

"It makes me think having had a clean-out, whether China is turning into a buyer. Open interest is up again. People are buying the December contract in Shanghai and I wonder why. Makes me think the smart money in Shanghai knows something London doesn't."

Lead continued to hold the limelight, up US$6 at US$2,056, though off Wednesday's near-one-year high of US$2,130 on worries that a pollution crackdown in China that has already closed at least 240,000 tons of capacity, may spread.

In a note, Barclays Capital said the greatest risk to the market came from longer term or permanent closures of smaller, more polluting smelters.

"Given that these smelters can be an important source of supply in periods of peak seasonal demand this could make the market feel much tighter going into the fourth quarter."

Aluminum rose US$2 to US$1,870. LME inventories stand at 4.62 million tons and China's top producer, Aluminum Corp of China, said privately held stocks in the country totaled 500,000 to 600,000 tons.

However, the International Aluminum Institute said total aluminum smelter stocks excluding finished end-products fell to 2.279 million tons at the end of July versus a revised 2.333 million in June.

(China Daily August 28, 2009)