The US national debt debate: What's at stake?

The US has just survived a potential government shut down because of the lack of a fiscal year 2011 budget. The politicians came to an agreement at the last minute and the "much ado about nothing," quickly passed. The average American was left wondering what all the fuss was about as there were no tangible affects from the showdown in Washington other than the media was able to sell a lot of stories on the issue during the two weeks leading up to the deadline.

|

|

|

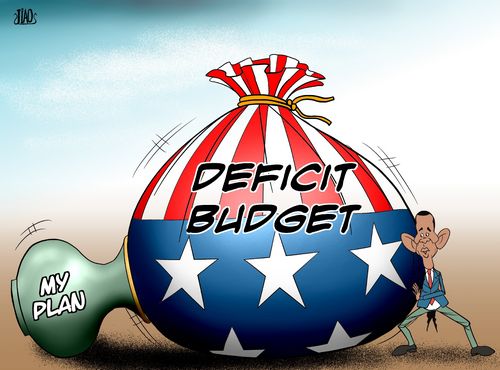

Mission impossible? [By Jiao Haiyang/China.org.cn] |

The US is one of a few countries that cannot borrow money unless authorized to do so by legislation. Among other things, our legislatures mandate an upper limit to the total amount borrowed. During the 2011 budget crisis, little press attention was given to the fact that the US will reach its current debt limit of $14.3 trillion by about May 16; give or take a few days. But, unlike the 2011 budget crisis, the approaching national debt limit crisis really is important for many subtle and not so subtle reasons.

There are only two real questions in Finance: How much is going to be paid and when? It is a fundamental law of nature that anytime there is uncertainty about the answers, capital markets and investors all over the world get very nervous. When investors are nervous, things change, and the consequences of those changes can be formidable.

Presently, US politicians are interjecting significant uncertainty into global capital markets as to whether interest and principle payments on US Treasury obligations will be paid in a timely manner. When investors, either domestic or foreign, have concerns about whether they will be paid on time, their desire to invest is less; thus the prices for such securities will be reduced. Consequently, the yields will be higher. In other words, investors everywhere will demand higher yields on US Treasury securities as long as the political process in Washington is unsettled.

Immediately, the US government will pay more than otherwise for the borrowing that it does, no matter what the level of its borrowing. This burden will eventually fall on the shoulders of US tax payers. Indirectly, all Americans will pay the penalty over and over again. For example, many US home mortgage rates are linked to the yields on 10 year US Treasury bonds. So, if rates on these securities increase, so will rates for residential mortgagees. In addition, if the rates for commercial loans go up, the merchants will pass their higher costs on to their retail customers. Consumers will also pay higher interest rates on consumer credit because most consumer credit interest rates are indexed against some form of US Treasury debt.

In conclusion, it is my opinion the US cannot afford the luxury of a protracted debate on the issue of whether to raise the limit on its national debt or not; especially in conjunction with the various political agendas that are currently being promoted in the US Congress. It is foolish to tie ideologies to a bill authorizing higher, but necessary, debt limits. Political dogmas are nothing more than distractions, and they have little to do with good financial and fiscal practices. In the end, the US national debt ceiling will have to be raised and, to calm world-wide capital markets, sooner is better than later.

The author is a columnist with China.org.cn. For more information please visit: http://m.formacion-profesional-a-distancia.com/opinion/node_7078635.htm

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.

0

0