Fairy stories about China's 'economic crisis'

- By John Ross

0 Comment(s)

0 Comment(s) Print

Print E-mail

China.org.cn, December 14, 2011

E-mail

China.org.cn, December 14, 2011

The present rapid shifts in the international and Chinese economic situations, resulting from the second wave of the international financial crisis centered on the Eurozone, are a challenge both to policy makers and a major opportunity for those engaged with China's 'soft power.'

|

|

|

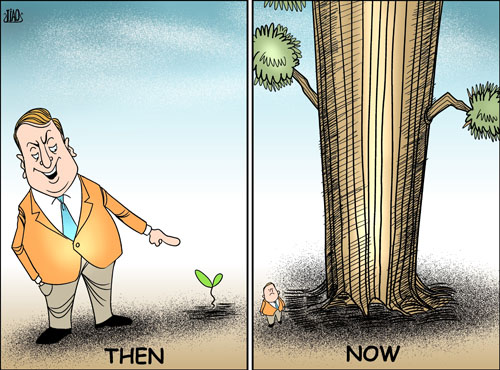

China speed [By Jiao Haiyang/China.org.cn] |

The reasons for this are the same as those when I ran a consulting company and knew inaccurate media analysis was an opportunity to make a profit. Businesses need accurate information to take correct decisions. If a newspaper writes an economy is going to boom when actually it suffers recession, the paper doesn't directly lose anything, but a company acting on the wrong analysis can lose a great deal of money. Economic and business writing therefore operates under an objective discipline which doesn't necessarily exist elsewhere - companies rationally pay a great deal of money for accurate information.

The reason a similar opening exists in China at present is that attempts are being made to convince businesses that China faces an 'economic crisis' on the same scale as that hitting the European Union (EU) and the US. This view is factual nonsense, as any comparison of economic data shows. In the four years to the latest data the US economy grew by 0.5 percent, the EU's shrank by 0.3 percent, and China's economy grew by 42.2 percent. Given such comparisons claims that China is suffering from 'crisis' is rather like saying the US has cholera, the EU has typhoid, and China has a cold and therefore they are basically in the same situation as 'all are ill'. Such claims destroy rational scales of comparison and are therefore wholly misleading in predicting what will happen.

China's economy naturally faces problems - all economies always face problems. It has had excessive house price increases, which are now gradually coming under control, and its consumer price index has been too high - although again it is now falling. Recession in the Eurozone will reduce orders to China's exporters. But China's economic year on year growth rate in the last quarter was 9.1 percent compared to 1.5 percent for the US and 1.4 percent for the EU. If the US and EU were paralleling China's growth far from claiming, this was a 'crisis' they would be calling it an unprecedented boom!

A typical example of such fairy stories regarding China's 'economic crisis' was a recent article in the Wall Street Journal by Nouriel Roubini, known as Dr. Doom in the economics profession, and Ian Bremmer president of the Eurasia Group - a risk analysis company. This was entitled 'Whose economy has it worst?' and was introduced: 'With Europe, China and the US in crisis, the real question is which of them will stumble first.' Jim Chanos, a famous short-seller, predicted China was 'like Dubai times 1,000, or worse.' The data already given above show such statements are purely bombast - there is no crisis in China's economy similar to the US or EU.