What the world is watching at the Xi-Trump summit

- By John Ross

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, April 5, 2017

E-mail China.org.cn, April 5, 2017

|

|

|

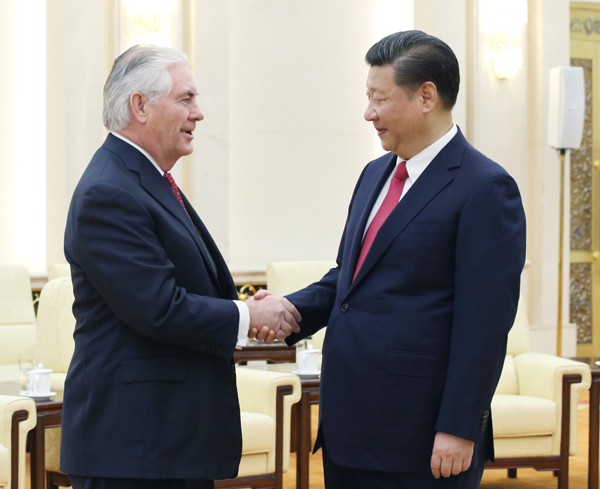

President Xi Jinping tells visiting US Secretary of State Rex Tillerson that the nations should enhance exchanges at all levels. They met on Sunday at the Great Hall of the People in Beijing. [Photo/Xinhua] |

The eyes of not only China and the U.S., but of the world, will be on the President Xi Jinping-President Trump summit.

It would be a mistake to believe that only these countries have direct stakes in its success and all other countries are simply passive bystanders. Given the world's interconnected character, both China and the U.S. have to take into account the positions of other countries in forming the most effective national policy.

The reality is that the rest of the world has a direct interest in China's "win-win" approach, rather than any "American first" policy of the type some advisers in the Trump administration have verbally advocated -- although, to be fair, not yet acted on.

This is of direct help to China. Indeed, for reasons analysed below, China's policy is objectively more in the interests of the American people than are the alternatives. First the bilateral and then the multilateral aspects of these realities will be analysed.

The situation is clearest starting with the fundamentals. The U.S. contains 4 percent of the world's population, China has 19 percent. The U.S. is 25 percent of the world economy at current exchange rates, and 17 percent in comparable international prices (purchasing power parities -- PPPs). China is 15 percent of the world economy at current exchange rates and 17 percent in PPPs.

China and the U.S. are both approximately one sixth of the world economy in PPPs; the U.S. about one quarter at current exchange rates. They are the world's two largest economies and trading nations, creating a huge value of $519 billion in bilateral trade in 2016.

China's weight in the world economy has rapidly increased and the U.S.'s has declined. In 1980 in PPPs, preferable for long term comparisons, the U.S. was 22 percent of the world economy and China was only 2 percent. But China and the U.S. are at different levels of development.

China is one of the world's most advanced developing economy; by 2016 only 12 percent of the population of the developing countries was in states with higher per capita GDPs than China. The U.S. is the world's most advanced major economy.

In 2016 U.S. per capita GDP was $57,300 calculated in either current exchange rates or PPPs. For realistic comparisons of economic development, PPPs are preferable, and by this measure China's per capita GDP was 27 percent of the U.S.

Such differences mean both countries gain greatly from mutual trade. China possesses an overwhelming cost advantage compared to the U.S. in medium technology products -- including numerous consumer goods. As Wang Wen, executive dean of Chongyang Institute for Financial Studies, recently noted in the Financial Times: "Around $233.8 billion worth of consumer goods… were imported from China to the U.S. in 2015. According to Oxford Economics, U.S.-China trade helps each American family save $850 every year."

Proposals from some U.S. figures to impose tariffs on Chinese imports would therefore mean a significant reduction in U.S. living standards due to the higher price of producing such goods in the U.S.

Nor would tariffs create U.S. jobs. A recent study of the 2009 U.S. tariff on tire imports from China found it raised the annual cost of tires to U.S. customers by $1.1 billion -- 1,200 jobs were added in the U.S. tire industry but costing $900,000 each. As U.S. tire workers' average annual salary was $40,070, it would have cost only a tiny fraction of these losses to U.S. consumers to directly subsidize tire workers.

The $1.1 billion extra spent on tires could not be spent on other items, causing job reductions in other parts of the U.S. economy -- 3,700 jobs were lost in U.S. retail compared to 1,200 gained in manufacturing. Anti-China tire tariffs therefore cost U.S. customers $1.1 billion and reduced the number of U.S. jobs by 2,500.

But conversely the U.S. has a competitive advantage compared to China in high technology products. Therefore, a strong mutually beneficial relation exists if China exports consumer and other medium technology products to the U.S. and imports high technology U.S. products. This parallels the highly mutually beneficial relations of Germany and China -- China in 2016 overtook the U.S. and France to become Germany's largest trading partner. Germany exports high quality capital equipment and similar products to China and imports China's consumer products in return.

Any "trade war" between the U.S. and China would therefore be "lose-lose" -- raising costs and lowering living standards, therefore costing jobs, in both countries.

But the combined size of both the U.S. and Chinese economies, which in real terms only amounts to slightly over one third of the world GDP, means neither can dictate policy for the world economy even if it wished.

"America first" means that over 95 percent of the world's population, and over three quarters of the world's economy, is supposed to subordinate itself to the U.S. - which they will not do. The days are gone when the U.S. represented by some calculations almost half the world economy and could dictate the structure of the international order.

Similarly, a sensationalist book titled "When China Rules the World" was created by an editor to produce an international best seller, but China cannot "rule the world" even if it wanted. This is why, in addition to bilateral ties, both China and the U.S. have to take into account the other countries which together make up the majority of the world economy.

China's "win-win" approach gives it a key advantage. If the U.S. lowers its living standards by cutting off imports of cost competitive Chinese products, other countries will not follow suit -- they simply want access to China's huge import market to sell goods in which they have a competitive advantage. Other countries are interested in maximizing global trade -- the foundation of China's "win-win."

China and the U.S. have an interest in a successful summit -- so does the rest of the world.

The author is Senior Fellow of Chongyang Institute for Financial Studies, Renmin University of China.

John Ross is a columnist with China.org.cn. For more information please visit:

http://m.formacion-profesional-a-distancia.com/opinion/johnross.htm

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.