0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, September 9, 2024

E-mail China.org.cn, September 9, 2024

"This was the most excellent outcome. It's what everyone desired," said George Elombi, executive vice president of the African Export-Import Bank, reflecting on the 2024 Summit of the Forum on China-Africa Cooperation (FOCAC).

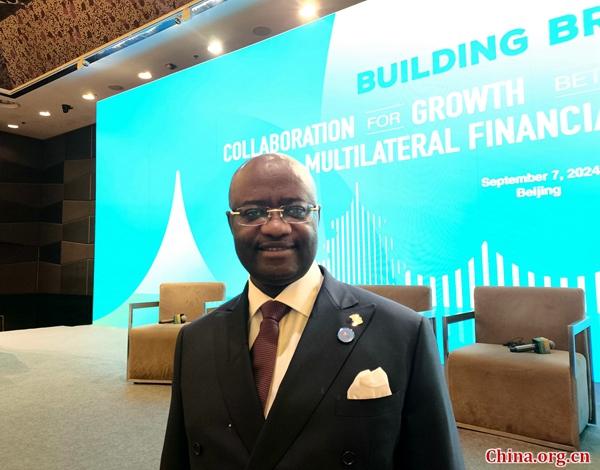

George Elombi, executive vice president of the African Export-Import Bank, poses for a photo at the symposium "Building Bridges: Collaboration for Growth Between China and African Multilateral Financial Institutions" in Beijing, Sept. 7, 2024. [Photo by Xu Xiaoxuan/China.org.cn]

Elombi spoke Saturday at the "Building Bridges: Collaboration for Growth Between China and African Multilateral Financial Institutions" symposium in Beijing. The event was co-hosted by the Alliance for African Multilateral Financial Institutions (AMFIs) and the African Union, with support from Development Reimagined, a Beijing-based international development consultancy.

The event aimed to boost cooperation between China and African financial institutions, spur economic growth across Africa and create mutually beneficial outcomes.

The symposium titled "Building Bridges: Collaboration for Growth Between China and African Multilateral Financial Institutions" is held in Beijing, Sept. 7, 2024. [Photo by Xu Xiaoxuan/China.org.cn]

Elombi highlighted decades of Chinese investments in Africa, noting projects of all sizes have benefited millions. Data from China's Ministry of Commerce shows that by the end of 2023, China's direct investment in Africa exceeded $40 billion, making it a major source of foreign investment on the continent.

He emphasized the enduring partnership between China and Africa, rooted in their shared future. He said the two sides must work together due to their interconnected destinies.

Albert Muchanga, AU commissioner for Economic Development, Trade, Tourism, Industry, and Minerals, echoed Elombi's sentiment. Muchanga said collaboration is more rewarding than acting alone and emphasized that cooperation between China and African multilateral financial institutions shows a shared commitment to progress.

Hannah Ryder, CEO of Development Reimagined, highlighted China's expanded financial, trade, industrial and investment commitments to Africa during the 2024 FOCAC Summit. These include a 210 billion yuan ($30 billion) credit line, the promotion of the Pilot Zone for In-depth China-Africa Economic and Trade Cooperation, and the launch of the "African Small- and Medium-sized Businesses Empowerment Program."

During the panel, participants discussed ways to strengthen financial and trade ties between African multilateral financial institutions and Chinese private companies.

Kenneth Tanyi, from the Membership & Partnership Development of the African Trade and Investment Development Insurance, praised China's decision to grant zero-tariff treatment to all least developed countries with diplomatic ties to China, including 33 African nations.

Tanyi said this move, announced during the 2024 FOCAC Summit, presents significant opportunities for Africa. He added that his organization would provide risk mitigation for Chinese trade and investment on the continent.

Wang Luo, director of the Institute of International Development and Cooperation under the Chinese Academy of International Trade and Economic Cooperation, stressed the importance of the African Continental Free Trade Area. Wang said the large, unified market is more attractive to investors than individual African countries.

However, Wang pointed out that Africa must improve its financial systems, tax policies and other relevant frameworks to attract more high-quality investment — just as China did when it sought to join the World Trade Organization.