The People's Bank of China (PBOC), the central bank, said here on Saturday China welcomed the approval of the massive U.S. financial rescue plan and hoped it would be implemented as soon as possible and achieve positive results.

House passes bailout, Bush signs

House passes bailout, Bush signs

"We are glad to see the passage of the rescue bill by the U.S. House of Representatives and the Senate despite earlier twists and turns," a PBOC spokesman said.

"The Chinese government has been closely following the developments of the U.S. financial crisis and its impact. The U.S. financial rescue plan proposed by the U.S. government has been a global focus recently."

|

|

|

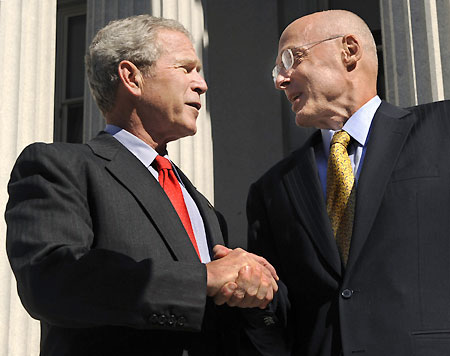

US President George W. Bush (L) shakes hands with Treasury Secretary Henry Paulson as he departs the Treasury Building after thanking Treasury workers for their efforts after the House passed the $700 billion financial rescue legislation, in Washington October 3, 2008. [Agencies] |

The bank was responding to the U.S. House of Representatives approval of the revised bailout plan, which was immediately signed into law by President George W. Bush. On Monday, the House rejected the original rescue legislation, sending global markets into a freefall.

The spokesman said the PBOC expected the implementation of the 700 billion U.S. dollar rescue plan to bail out troubled banks would stabilize the U.S. and global financial markets and restore investor confidence.

He added China was willing to enhance coordination and cooperation with the United States and other economies to overcome the current difficulties and stabilize the international financial market.

"China and the United States of America share common interests in stabilizing the international financial markets."

The spokesman said the fundamentals of the Chinese economy remained unchanged and its financial market was safe and stable with generally adequate liquidity.

The economy was developing toward a direction guided by the government's macro-economic control polices and had great potential for sustainable growth.

"We have full confidence in the development of the Chinese economy and the stability of our financial market."

According to the spokesman, the PBOC and other Chinese regulatory departments had worked out various response plans to avoid or reduce the impact of the U.S. financial crisis on the domestic economy.

|

|

Traders work on the floor of the New York Stock Exchange, October 3, 2008. US stocks fell, shedding earlier gains on Friday, as concerns about the economy overshadowed the US House of Representatives' approval of the Bush administration's $700 billion financial rescue package. [Agencies] |

The PBOC would continue its close contact and cooperation with other central banks and international financial organizations to jointly deal with the financial crisis.

"We are fully confident and capable of safeguarding China's economic development and the stability of its financial market to make contributions to the stable development of the world economy," he added.?

Chinese economic analysts react cautiously

As central banks in China and other economies welcomed the U.S. rescue plan, Chinese economic analysts said the plan might temporarily restore investor confidence and keep the troubled U.S. financial system functioning.

But they cautioned such a plan was unlikely to address the root problems in the U.S. financial market and the U.S. sub-prime mortgage crisis was far from over.

Sun Lijian, an economist with the Shanghai-based Fudan University, said the massive rescue plan was not expected to bring the U.S. financial market out of the turmoil in a short period of time.

"Such a large-scale financial intervention can only keep the crippled U.S. financial market continuing to run," he told the Shanghai Evening Post. "No one is expecting the rescue plan to invigorate the U.S. financial market. In fact, the sub-prime crisis is far from over."

Xu Guoxiang, an economic professor at Shanghai University of Finance and Economics, echoed such a view. "The rescue plan addresses symptoms of the financial crisis, not the root cause," he said.

U.S. stocks were expected to continue tumbling and what the plan could do was to slow the falling pace, Xu said. "Currently, it is really hard to solve the fundamental problem of low market confidence among U.S. investors."

Tang Min, China Development Research Foundation deputy secretary, added the passage of the rescue bill didn't indicate the U.S. financial turmoil was over.

"I am not optimistic over the U.S. financial crisis. As many economists have said, it is the most serious economic crisis in more than 100 years. Surely, it is the most serious since the 1929 Great Depression," Tang told China Central Television.

The U.S. economy was likely to continue experiencing a long downturn period and a great deal of economic data had indicated such a judgement, he said.

Tang urged China to boost domestic consumption and offset the impact?on the economy since exports would slow amid weaker demand for Chinese products owing to the global economic depression.

"We don't have many alternatives. In fact, many Chinese exporting enterprises are running into difficulties. We have to take some measures to encourage domestic consumption."

(Xinhua News?Agency October 4, 2008)