China faces the Eurozone's 'currency war'

- By John Ross

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, March 12, 2015

E-mail China.org.cn, March 12, 2015

Present short term shifts in capital flows undoubtedly create significant problems for China. For those engaged in short term speculation, or who see their interests primarily in currencies other than the RMB, even the 4 percent fall in the exchange rate of the yuan against the dollar is a significant shift. Therefore short term capital movements out of China began late in 2014. By draining funds and liquidity from China this places downward pressure on its economy. Countering this downward pressure is one reason China's central bank recently cut interest rates and relaxed bank reserve requirements. Such capital outflows are negative for China and an illustration of why liberalization of its capital account would have dangerous consequences.

But for China's long term FDI the strengthening of the RMB against the euro is advantageous as it lowers the price in RMBs of assets purchased in Euros. FDI is also driven by more long term structural features than short term capital flows or even trade.

Due to the small size of Japan's economy, compared to the United States or EU, and to political tensions, Japan is not a key target for China's outward FDI and therefore yen devaluation is unlikely to produce strong effects in stimulating China's FDI by investment in Japan. But the euro is different – the EU is a key target for China's overall FDI expansion.

As recently as 2010, the total stock of China's FDI in the EU was less than US$5 billion. By the end of 2012, Chinese investment stock had quadrupled, to US$21 billion, according to Deutsche Bank figures. By 2014 the annual flow of China's FDI into Europe was US$18billion according to data from Rhodium.

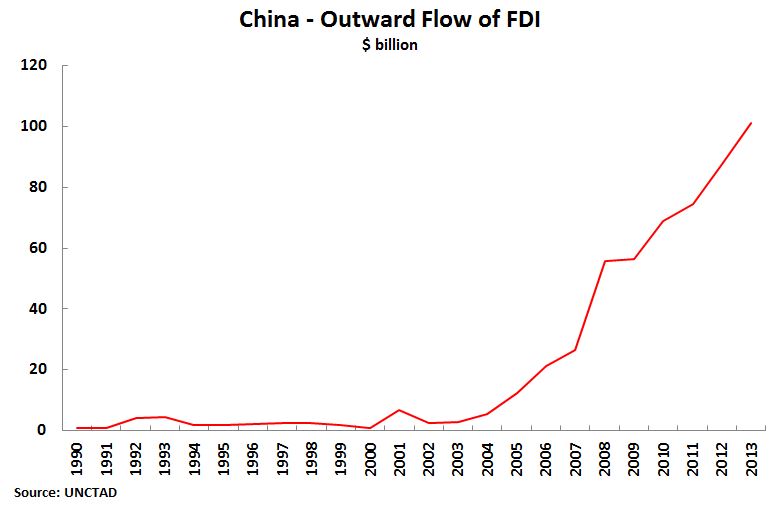

The background to this is the very rapid overall growth of China's outward FDI. The average annual rate of increase of outward world FDI from 2000 to2013, the latest available data, was only 1 percent. There was a 9 percent average annual increase by developing economies and a 2 percent annual average contraction by advanced economies. But China's average annual increase in FDI was 44 percent. China's rapid build-up is shown in Figure 3.

|

|

But China is only at the beginning of FDI expansion. China's outward FDI in 2013, the latest year for comparative UN data, was US$101 billion – below Japan's US$136 billion and the United States' US$338 billion. Given China's formidable financial firepower, with the world's largest domestic savings, acceleration of China's FDI will increase. China speeded up investments in Europe during the Eurozone debt crisis, which made European assets cheaper, and their price in RMB has again fallen with Euro devaluation.

The recent sharp Euro devaluation, following that of the yen, will therefore speed up diversification of China's exports away from advanced economies, and is accompanied by difficult trends in short term capital movements, but it will not halt China's rapid build-up of outward FDI.

The writer is a columnist with China.org.cn. For more information please visit: http://china.org.cn/opinion/johnross.htm

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.